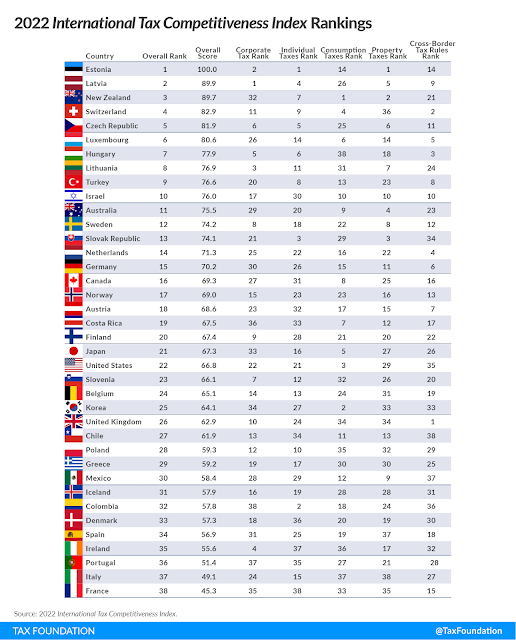

For the ninth year in a row, Estonia has the best tax code in the OECD (Organisation for Economic Co-operation and Development). Its top score is driven by four positive features of its tax system. First, it has a 20 percent tax rate on corporate income that is only applied to distributed profits. Second, it has a flat 20 percent tax on individual income that does not apply to personal dividend income. Third, its property tax applies only to the value of land, rather than to the value of real property or capital. Finally, it has a territorial tax system that exempts 100 percent of foreign profits earned by domestic corporations from domestic taxation, with few restrictions. Estonia's tax system makes it a very attractive place to conduct business.

Ilus Eesti, beautiful Estonia. My family's homeland. Estonia's countryside and people have an endearing gentleness about them which you fall in love with slowly and imperceptibly. I have nothing but respect and admiration for Estonians' courage and determination to survive despite centuries of repression, tyranny and foreign occupation. This blog aims to promote Estonian news, history and culture and seeks to enlighten readers about everything this unique country has to offer.